3 Ways to Use a Home Equity Loan: Get Started Today

Unlocking the equity you’ve built in your home can be a powerful financial tool. A home equity loan, also known as a second mortgage, allows you to borrow against your home’s value, giving you access to a lump sum of cash. But with this financial flexibility comes responsibility. How do you make the most of a home equity loan?

This guide explores three smart ways to use a home equity loan, helping you understand the potential benefits and drawbacks. Let’s dive in!

1. Home Improvement Projects: Giving Your Home a Facelift

Investing in your home can pay off in the long run, and a home equity loan can provide the funding for those much-needed upgrades. Whether it’s a kitchen remodel, a bathroom renovation, or adding a new deck, a home equity loan can help you realize your vision.

Benefits of Using a Home Equity Loan for Home Improvements:

- Increased Home Value: Upgrading your home can potentially increase its market value, making it a sound investment.

- Enhanced Enjoyment: Investing in home improvements can create a more functional, comfortable, and enjoyable living space.

- Lower Interest Rates: Home equity loans typically have lower interest rates than personal loans, making them a more cost-effective option for financing home improvements.

Things to Consider Before Using a Home Equity Loan for Home Improvements:

- Project Costs: Get accurate estimates from contractors before applying for a loan to ensure you’re borrowing enough funds.

- Resale Value: While some improvements, like kitchen and bathroom updates, tend to increase home value, others may not. Consider the potential return on your investment.

- Home Equity Loan Requirements: Be sure to review the terms and conditions of your loan to understand the repayment schedule and any associated fees.

2. Debt Consolidation: Simplifying Your Finances

Struggling with multiple high-interest debts, like credit cards or personal loans? A home equity loan can help you consolidate those debts into one lower-interest loan, potentially saving you money on interest payments.

Benefits of Using a Home Equity Loan for Debt Consolidation:

- Lower Interest Rates: Home equity loans generally have lower interest rates than credit cards or personal loans, allowing you to pay off debt faster and potentially save on interest.

- Simplified Payments: One monthly payment for all your debts can simplify your budgeting and reduce the risk of missed payments.

- Improved Credit Score: Paying down high-interest debt can boost your credit score, making it easier to access loans and credit in the future.

Things to Consider Before Using a Home Equity Loan for Debt Consolidation:

- Credit Score Impact: While consolidating debt can improve your credit score in the long run, taking out a new loan might temporarily lower your score.

- Repayment Flexibility: Home equity loans have fixed terms, so ensure you can handle the monthly payments for the duration of the loan.

- Loss of Equity: If you default on the loan, you risk losing your home.

3. Funding Major Life Events: Achieving Your Dreams

Home equity loans can also be used to finance major life events, such as paying for college tuition, medical expenses, or starting a business.

Benefits of Using a Home Equity Loan for Major Life Events:

- Access to Funds: A home equity loan provides a lump sum of cash that can address a variety of unexpected or planned expenses.

- Flexibility: You can use the funds for a wide range of purposes, giving you the freedom to achieve your financial goals.

- Lower Interest Rates: Compared to other loan options, home equity loans can offer more favorable interest rates.

Things to Consider Before Using a Home Equity Loan for Major Life Events:

- Debt-to-Income Ratio: Ensure your debt-to-income ratio remains manageable after taking out the loan to avoid financial hardship.

- Long-Term Financial Impact: Carefully consider the long-term financial implications of taking on additional debt.

- Alternative Funding Sources: Explore alternative financing options, such as personal loans or family loans, before resorting to a home equity loan.

How to Apply for a Home Equity Loan

Ready to explore home equity loans? Here’s a step-by-step guide:

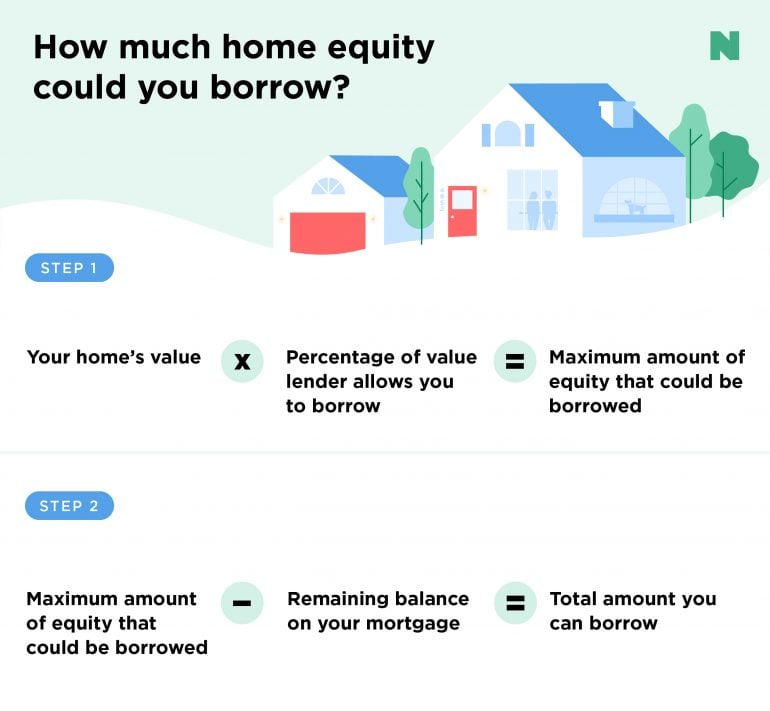

- Assess Your Home Equity: Determine the value of your home and subtract any outstanding mortgage balances to calculate your home equity.

- Shop Around for Lenders: Compare interest rates, fees, and loan terms from different lenders to ensure you’re getting the best deal.

- Prepare Necessary Documents: Gather the required documentation, including your income verification, credit history, and proof of homeownership.

- Submit Your Application: Complete and submit your loan application.

- Loan Appraisal: A professional appraiser will evaluate your home’s value to ensure it meets the lender’s requirements.

- Loan Approval: Once your application is approved, you’ll receive a loan agreement outlining the terms and conditions of the loan.

FAQs About Home Equity Loans

Q: What is the maximum amount I can borrow with a home equity loan?

Suggested read: Illuminate Your Kitchen Island with Modern Pendant Lighting

A: Lenders typically allow you to borrow up to 80{136bb9da91d0b20a9aa21cd0a10733cce308d25764240ac883341553e88ca1a4} of your home’s value, but this can vary depending on your credit score and other factors.

Q: How long does it take to get approved for a home equity loan?

A: The approval process usually takes a few weeks, depending on the lender and the complexity of your application.

Q: What are the potential risks associated with a home equity loan?

A: If you default on the loan, you risk losing your home. Additionally, taking out these loans can increase your debt-to-income ratio, potentially impacting your ability to qualify for other loans or credit in the future.

Conclusion

A home equity loan can be a valuable financial tool, but it’s crucial to understand the risks and benefits before taking out this type of loan. By carefully planning your financial goals and choosing the right home equity loan, you can use this resource to improve your home, consolidate debt, or finance major life events.

Key Takeaways:

Suggested read: Elegantly Durable: Enhance Your Kitchen with a Copper Sink Faucet

- Home equity loans can provide access to a lump sum of cash by borrowing against your home’s value.

- Consider the potential risks and benefits before deciding to use a home equity loan.

- Explore various financing options to find the most suitable solution for your needs.

- Research and compare different lenders to secure the best loan terms.

By utilizing home equity loans responsibly and strategically, you can unlock the potential of your home’s value and achieve your financial goals.

3 Ways to Use a Home Equity Loan: Get Started Today

Unlocking the equity you’ve built in your home can be a powerful financial tool. A home equity loan, also known as a second mortgage, allows you to borrow against your home’s value, giving you access to a lump sum of cash. But with this financial flexibility comes responsibility. How do you make the most of a home equity loan?

This guide explores three smart ways to use a home equity loan, helping you understand the potential benefits and drawbacks. Let’s dive in!

1. Home Improvement Projects: Giving Your Home a Facelift

Investing in your home can pay off in the long run, and a home equity loan can provide the funding for those much-needed upgrades. Whether it’s a kitchen remodel, a bathroom renovation, or adding a new deck, a home equity loan can help you realize your vision.

Benefits of Using a Home Equity Loan for Home Improvements:

- Increased Home Value: Upgrading your home can potentially increase its market value, making it a sound investment.

- Enhanced Enjoyment: Investing in home improvements can create a more functional, comfortable, and enjoyable living space.

- Lower Interest Rates: Home equity loans typically have lower interest rates than personal loans, making them a more cost-effective option for financing home improvements.

Things to Consider Before Using a Home Equity Loan for Home Improvements:

- Project Costs: Get accurate estimates from contractors before applying for a loan to ensure you’re borrowing enough funds.

- Resale Value: While some improvements, like kitchen and bathroom updates, tend to increase home value, others may not. Consider the potential return on your investment.

- Home Equity Loan Requirements: Be sure to review the terms and conditions of your loan to understand the repayment schedule and any associated fees.

2. Debt Consolidation: Simplifying Your Finances

Struggling with multiple high-interest debts, like credit cards or personal loans? A home equity loan can help you consolidate those debts into one lower-interest loan, potentially saving you money on interest payments.

Benefits of Using a Home Equity Loan for Debt Consolidation:

- Lower Interest Rates: Home equity loans generally have lower interest rates than credit cards or personal loans, allowing you to pay off debt faster and potentially save on interest.

- Simplified Payments: One monthly payment for all your debts can simplify your budgeting and reduce the risk of missed payments.

- Improved Credit Score: Paying down high-interest debt can boost your credit score, making it easier to access loans and credit in the future.

Things to Consider Before Using a Home Equity Loan for Debt Consolidation:

- Credit Score Impact: While consolidating debt can improve your credit score in the long run, taking out a new loan might temporarily lower your score.

- Repayment Flexibility: Home equity loans have fixed terms, so ensure you can handle the monthly payments for the duration of the loan.

- Loss of Equity: If you default on the loan, you risk losing your home.

3. Funding Major Life Events: Achieving Your Dreams

Home equity loans can also be used to finance major life events, such as paying for college tuition, medical expenses, or starting a business.

Suggested read: Your Kitchen's Trash Can: Finding the Right Size for the Job

Benefits of Using a Home Equity Loan for Major Life Events:

- Access to Funds: A home equity loan provides a lump sum of cash that can address a variety of unexpected or planned expenses.

- Flexibility: You can use the funds for a wide range of purposes, giving you the freedom to achieve your financial goals.

- Lower Interest Rates: Compared to other loan options, home equity loans can offer more favorable interest rates.

Things to Consider Before Using a Home Equity Loan for Major Life Events:

- Debt-to-Income Ratio: Ensure your debt-to-income ratio remains manageable after taking out the loan to avoid financial hardship.

- Long-Term Financial Impact: Carefully consider the long-term financial implications of taking on additional debt.

- Alternative Funding Sources: Explore alternative financing options, such as personal loans or family loans, before resorting to a home equity loan.

How to Apply for a Home Equity Loan

Ready to explore home equity loans? Here’s a step-by-step guide:

- Assess Your Home Equity: Determine the value of your home and subtract any outstanding mortgage balances to calculate your home equity.

- Shop Around for Lenders: Compare interest rates, fees, and loan terms from different lenders to ensure you’re getting the best deal.

- Prepare Necessary Documents: Gather the required documentation, including your income verification, credit history, and proof of homeownership.

- Submit Your Application: Complete and submit your loan application.

- Loan Appraisal: A professional appraiser will evaluate your home’s value to ensure it meets the lender’s requirements.

- Loan Approval: Once your application is approved, you’ll receive a loan agreement outlining the terms and conditions of the loan.

FAQs About Home Equity Loans

Q: What is the maximum amount I can borrow with a home equity loan?

A: Lenders typically allow you to borrow up to 80{136bb9da91d0b20a9aa21cd0a10733cce308d25764240ac883341553e88ca1a4} of your home’s value, but this can vary depending on your credit score and other factors.

Q: How long does it take to get approved for a home equity loan?

A: The approval process usually takes a few weeks, depending on the lender and the complexity of your application.

Q: What are the potential risks associated with a home equity loan?

A: If you default on the loan, you risk losing your home. Additionally, taking out these loans can increase your debt-to-income ratio, potentially impacting your ability to qualify for other loans or credit in the future.

Suggested read: Modern Metal Kitchen Units: A Culinary Oasis

Conclusion

A home equity loan can be a valuable financial tool, but it’s crucial to understand the risks and benefits before taking out this type of loan. By carefully planning your financial goals and choosing the right home equity loan, you can use this resource to improve your home, consolidate debt, or finance major life events.

Key Takeaways:

- Home equity loans can provide access to a lump sum of cash by borrowing against your home’s value.

- Consider the potential risks and benefits before deciding to use a home equity loan.

- Explore various financing options to find the most suitable solution for your needs.

- Research and compare different lenders to secure the best loan terms.

By utilizing home equity loans responsibly and strategically, you can unlock the potential of your home’s value and achieve your financial goals.

So, you’ve finally read about the three most common ways to use a home equity loan. And now you’re probably itching to get started, right? It’s great to have the knowledge, but it’s even better to put this information into action! Remember, home equity lending can be a powerful tool to reach your financial goals. It’s not a quick fix, but it can be a significant asset for your long-term vision. Whether you’re consolidating debt, funding a dream renovation, or investing in your future, a home equity loan can be the key to unlocking your financial potential.

Before you leap into action, however, there are a few things to consider. First, make sure you understand the fine print of the loan. Read the terms carefully and analyze the interest rates, fees, and repayment terms. It’s essential to compare different lenders and find an option that aligns with your financial situation and objectives. Second, remember that home equity loans aren’t magic money. It’s imperative to have a realistic budget in place and stick to it. Plan carefully, and make sure the loan fits seamlessly into your financial plan. Finally, make sure to use this loan responsibly. Don’t let a quick fix turn into a long-term burden.

The path to financial freedom can feel daunting. But, with the right tools and a thoughtful approach, a home equity loan can be a valuable ally. Consider this blog post your compass. Use the information to chart your course, but remember to adjust your journey as needed. Now, go chase your financial goals!