5 Ways to Use a Home Equity Loan: Defined & Explained

Have you built up substantial equity in your home? If so, you might be wondering about the different ways you can tap into that wealth. A home equity loan may be the perfect solution, granting you access to a sizable lump sum of cash, often at a lower interest rate than other loan options.

But before you jump into getting a home equity loan, it’s essential to understand how it works, what it’s best used for, and the potential risks involved. This article will delve into the world of home equity loans, exploring five common uses, their advantages and disadvantages, and helping you determine if this financial tool is right for you.

What is a Home Equity Loan?

A home equity loan is a type of secured loan where your home acts as collateral. Lenders feel more secure offering you a lower interest rate because they have a claim on your property. Essentially, you’re borrowing against the value of your home, but you’ll need to have accumulated sufficient equity, the difference between your home’s value and what you owe on your mortgage.

Think of home equity as a “second mortgage.” It’s a separate loan from your primary mortgage, allowing you to borrow a specific amount at a fixed interest rate over a set term. This loan is typically offered as a lump sum that’s paid back in monthly installments.

5 Ways to Use a Home Equity Loan

A home equity loan can be a versatile tool for a variety of financial needs. Here are five common ways people use this type of loan:

1. Home Improvements

One of the most popular reasons to get a home equity loan is to finance renovations or improvements. This could include anything from updating your kitchen or bathroom to adding an extension or finishing your basement. Home equity loans can provide a significant sum to make significant improvements, boosting your home’s value and overall enjoyment.

Example: Let’s say you want to replace your old, inefficient windows with energy-efficient ones. A home equity loan can cover the cost of materials and installation, potentially helping you save on energy bills and increase your home’s resale value.

2. Debt Consolidation

Debt consolidation can be a smart strategy for simplifying your finances and potentially lowering your overall interest payments. Home equity loans often offer lower interest rates compared to credit cards or personal loans, making them a useful tool for consolidating various debts, such as:

- Credit Card Debt: High-interest credit card debt is often targeted for consolidation. Combining several credit cards into a single loan with a lower interest rate can save you substantial money in interest charges.

- Medical Bills: Medical expenses can be overwhelming. Home equity loans can provide a lump sum to pay off medical bills, potentially saving you from high interest rates and late payment penalties.

- Student Loans: While there are federal programs for student loan consolidation, a home equity loan may be an option if you’re looking for a faster consolidation process or a lower interest rate.

3. Business Funding

Starting or expanding a business can be expensive. If you have a solid business plan and good credit, a home equity loan can provide the capital needed to get your venture off the ground or take it to the next level.

Example: An entrepreneur might leverage a home equity loan to invest in new equipment, hire additional staff, or expand their inventory, opening up new growth opportunities.

4. Major Purchases

Home equity loans can also be helpful for funding significant purchases, such as:

- Vehicles: Buying a new or used car can be a big expense. Home equity loans can provide a lower interest rate than a car loan, especially if you have excellent credit.

- Education: If you’re planning to go back to school or help a child fund their education, a home equity loan can cover the cost of tuition, books, and living expenses.

- Medical Expenses: As mentioned above, home equity loans can be helpful in paying for unexpected medical expenses or unforeseen medical procedures.

5. Special Needs

Sometimes life throws curveballs, and we need financial assistance to manage unexpected situations. Home equity loans can be helpful in these scenarios:

- Emergency Expenses: Unexpected home repairs, medical emergencies, or family crises can be costly. Home equity loans can provide a quick source of cash to cover these unexpected expenses.

- Relocation: Moving to a new home can be a significant undertaking. Home equity loans can help fund the down payment for a new house, bridge the gap between selling your current home and buying a new one, or cover the cost of moving expenses.

The Pros and Cons of Home Equity Loans

While home equity loans can be quite useful, they come with both advantages and disadvantages. It’s important to weigh these before committing to a loan.

Advantages

- Lower Interest Rates: Compared to other loan options, such as credit cards or personal loans, home equity loans often have lower interest rates due to the security of your home as collateral.

- Fixed Interest Rates: Fixed interest rates provide predictable monthly payments and protect you from fluctuating interest rates.

- Large Loan Amounts: You can typically borrow larger sums with a home equity loan compared to other loan options.

- Tax Deductibility: The interest you pay on a home equity loan may be tax deductible if you use the loan for home improvements. Check with a tax professional for specific requirements and limitations.

Disadvantages

- Risk of Foreclosure: If you fail to make your loan payments, your lender could foreclose on your home. This could result in losing your home and potentially damaging your credit score.

- High Interest Rates: While generally lower than credit cards and personal loans, home equity loan interest rates can still be significant, especially if your credit score isn’t excellent.

- Limited Flexibility: Home equity loans typically have fixed payment terms, so if you need to change your payment amount or term, it can be difficult to do so.

Home Equity Loan vs. Home Equity Line of Credit (HELOC): What’s the Difference?

Home equity loans and home equity lines of credit (HELOCs) are both secured by your home’s equity. However, there are fundamental differences:

- Home Equity Loan: Provides a lump sum of cash upfront, with fixed monthly payments and a set term.

- Home Equity Line of Credit (HELOC): Acts like a credit card, offering a revolving line of credit you can borrow from as needed. You only pay interest on the amount you borrow, and the interest rate can vary.

The best option depends on your financial needs. If you need a fixed amount of cash for a specific purpose, a home equity loan might be suitable. If you need more flexibility to borrow money as needed, a HELOC could be a better choice.

How to Qualify for a Home Equity Loan

To qualify for a home equity loan, you’ll need to meet certain lender requirements, including:

- Good Credit Score: Lenders typically require a credit score of at least 620, although higher scores can lead to lower interest rates.

- Sufficient Equity: You’ll need to have a certain amount of equity in your home, typically 15-20{136bb9da91d0b20a9aa21cd0a10733cce308d25764240ac883341553e88ca1a4}, to qualify.

- Stable Income: Lenders will evaluate your income to ensure you can comfortably afford the monthly payments.

- Debt-to-Income Ratio (DTI): This ratio measures how much of your income is dedicated to debt payments. A lower DTI is generally better.

Key Takeaways

Home equity loans can be a valuable financial tool if used responsibly. They offer several benefits, from lower interest rates to the ability to borrow significant sums. However, it’s crucial to understand both the advantages and disadvantages before applying. The use of home equity loans should be carefully considered, and it’s essential to only utilize them for essential needs and to ensure you can comfortably afford the monthly payments.

FAQs

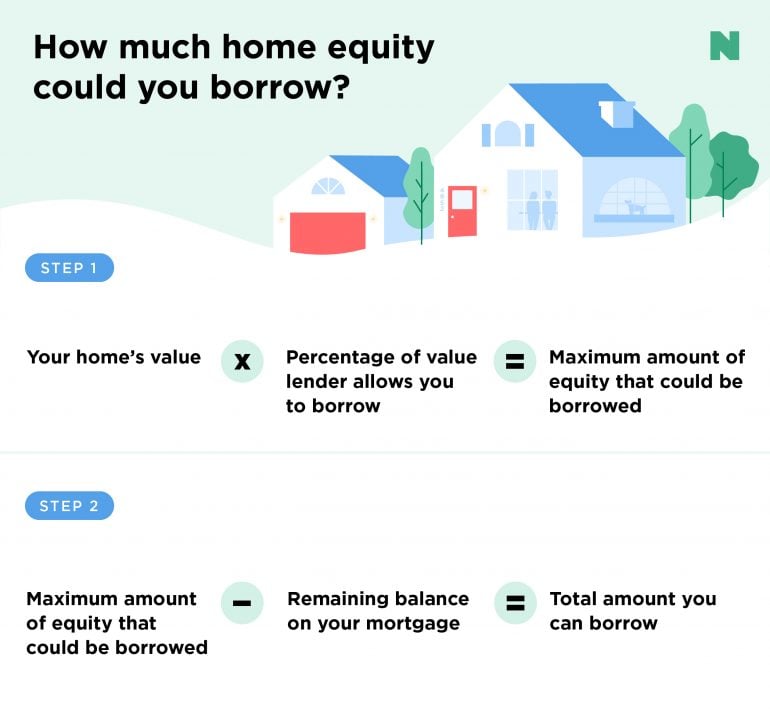

1. How much can I borrow with a home equity loan?

The maximum amount you can borrow depends on several factors, including the value of your home, your existing mortgage balance, and your credit score. Lenders typically allow you to borrow up to 80{136bb9da91d0b20a9aa21cd0a10733cce308d25764240ac883341553e88ca1a4} of your home’s equity.

2. What is the average interest rate for a home equity loan?

The average interest rate for a home equity loan varies depending on current market conditions, your credit score, and other factors. It’s always a good idea to compare rates from multiple lenders to find the best deal.

3. How long does it take to get approved for a home equity loan?

The approval process for a home equity loan can take anywhere from a few days to a couple of weeks. This depends on the individual lender and how quickly you can provide all the necessary documents.

4. What are the potential risks of a home equity loan?

The primary risk of a home equity loan is foreclosure if you fail to make your loan payments. This could lead to losing your home and damaging your credit score. It’s essential to ensure you can comfortably afford the monthly payments before taking out a loan.

5. Is a home equity loan the right choice for me?

Whether a home equity loan is right for you depends on your individual financial circumstances and needs. If you have built up substantial equity in your home, need a lump sum of cash, and have good credit, a home equity loan may be an option. However, it’s essential to carefully consider the risks and potential consequences before making a decision.

5 Ways to Use a Home Equity Loan: Defined & Explained

Have you built up substantial equity in your home? If so, you might be wondering about the different ways you can tap into that wealth. A home equity loan may be the perfect solution, granting you access to a sizable lump sum of cash, often at a lower interest rate than other loan options.

But before you jump into getting a home equity loan, it’s essential to understand how it works, what it’s best used for, and the potential risks involved. This article will delve into the world of home equity loans, exploring five common uses, their advantages and disadvantages, and helping you determine if this financial tool is right for you.

What is a Home Equity Loan?

A home equity loan is a type of secured loan where your home acts as collateral. Lenders feel more secure offering you a lower interest rate because they have a claim on your property. Essentially, you’re borrowing against the value of your home, but you’ll need to have accumulated sufficient equity, the difference between your home’s value and what you owe on your mortgage.

Think of home equity as a “second mortgage.” It’s a separate loan from your primary mortgage, allowing you to borrow a specific amount at a fixed interest rate over a set term. This loan is typically offered as a lump sum that’s paid back in monthly installments.

5 Ways to Use a Home Equity Loan

A home equity loan can be a versatile tool for a variety of financial needs. Here are five common ways people use this type of loan:

1. Home Improvements

One of the most popular reasons to get a home equity loan is to finance renovations or improvements. This could include anything from updating your kitchen or bathroom to adding an extension or finishing your basement. Home equity loans can provide a significant sum to make significant improvements, boosting your home’s value and overall enjoyment.

Example: Let’s say you want to replace your old, inefficient windows with energy-efficient ones. A home equity loan can cover the cost of materials and installation, potentially helping you save on energy bills and increase your home’s resale value.

2. Debt Consolidation

Debt consolidation can be a smart strategy for simplifying your finances and potentially lowering your overall interest payments. Home equity loans often offer lower interest rates compared to credit cards or personal loans, making them a useful tool for consolidating various debts, such as:

- Credit Card Debt: High-interest credit card debt is often targeted for consolidation. Combining several credit cards into a single loan with a lower interest rate can save you substantial money in interest charges.

- Medical Bills: Medical expenses can be overwhelming. Home equity loans can provide a lump sum to pay off medical bills, potentially saving you from high interest rates and late payment penalties.

- Student Loans: While there are federal programs for student loan consolidation, a home equity loan may be an option if you’re looking for a faster consolidation process or a lower interest rate.

3. Business Funding

Starting or expanding a business can be expensive. If you have a solid business plan and good credit, a home equity loan can provide the capital needed to get your venture off the ground or take it to the next level.

Example: An entrepreneur might leverage a home equity loan to invest in new equipment, hire additional staff, or expand their inventory, opening up new growth opportunities.

4. Major Purchases

Home equity loans can also be helpful for funding significant purchases, such as:

- Vehicles: Buying a new or used car can be a big expense. Home equity loans can provide a lower interest rate than a car loan, especially if you have excellent credit.

- Education: If you’re planning to go back to school or help a child fund their education, a home equity loan can cover the cost of tuition, books, and living expenses.

- Medical Expenses: As mentioned above, home equity loans can be helpful in paying for unexpected medical expenses or unforeseen medical procedures.

5. Special Needs

Sometimes life throws curveballs, and we need financial assistance to manage unexpected situations. Home equity loans can be helpful in these scenarios:

- Emergency Expenses: Unexpected home repairs, medical emergencies, or family crises can be costly. Home equity loans can provide a quick source of cash to cover these unexpected expenses.

- Relocation: Moving to a new home can be a significant undertaking. Home equity loans can help fund the down payment for a new house, bridge the gap between selling your current home and buying a new one, or cover the cost of moving expenses.

The Pros and Cons of Home Equity Loans

While home equity loans can be quite useful, they come with both advantages and disadvantages. It’s important to weigh these before committing to a loan.

Advantages

- Lower Interest Rates: Compared to other loan options, such as credit cards or personal loans, home equity loans often have lower interest rates due to the security of your home as collateral.

- Fixed Interest Rates: Fixed interest rates provide predictable monthly payments and protect you from fluctuating interest rates.

- Large Loan Amounts: You can typically borrow larger sums with a home equity loan compared to other loan options.

- Tax Deductibility: The interest you pay on a home equity loan may be tax deductible if you use the loan for home improvements. Check with a tax professional for specific requirements and limitations.

Disadvantages

- Risk of Foreclosure: If you fail to make your loan payments, your lender could foreclose on your home. This could result in losing your home and potentially damaging your credit score.

- High Interest Rates: While generally lower than credit cards and personal loans, home equity loan interest rates can still be significant, especially if your credit score isn’t excellent.

- Limited Flexibility: Home equity loans typically have fixed payment terms, so if you need to change your payment amount or term, it can be difficult to do so.

Home Equity Loan vs. Home Equity Line of Credit (HELOC): What’s the Difference?

Home equity loans and home equity lines of credit (HELOCs) are both secured by your home’s equity. However, there are fundamental differences:

- Home Equity Loan: Provides a lump sum of cash upfront, with fixed monthly payments and a set term.

- Home Equity Line of Credit (HELOC): Acts like a credit card, offering a revolving line of credit you can borrow from as needed. You only pay interest on the amount you borrow, and the interest rate can vary.

The best option depends on your financial needs. If you need a fixed amount of cash for a specific purpose, a home equity loan might be suitable. If you need more flexibility to borrow money as needed, a HELOC could be a better choice.

How to Qualify for a Home Equity Loan

To qualify for a home equity loan, you’ll need to meet certain lender requirements, including:

- Good Credit Score: Lenders typically require a credit score of at least 620, although higher scores can lead to lower interest rates.

- Sufficient Equity: You’ll need to have a certain amount of equity in your home, typically 15-20{136bb9da91d0b20a9aa21cd0a10733cce308d25764240ac883341553e88ca1a4}, to qualify.

- Stable Income: Lenders will evaluate your income to ensure you can comfortably afford the monthly payments.

- Debt-to-Income Ratio (DTI): This ratio measures how much of your income is dedicated to debt payments. A lower DTI is generally better.

Key Takeaways

Home equity loans can be a valuable financial tool if used responsibly. They offer several benefits, from lower interest rates to the ability to borrow significant sums. However, it’s crucial to understand both the advantages and disadvantages before applying. The use of home equity loans should be carefully considered, and it’s essential to only utilize them for essential needs and to ensure you can comfortably afford the monthly payments.

FAQs

1. How much can I borrow with a home equity loan?

The maximum amount you can borrow depends on several factors, including the value of your home, your existing mortgage balance, and your credit score. Lenders typically allow you to borrow up to 80{136bb9da91d0b20a9aa21cd0a10733cce308d25764240ac883341553e88ca1a4} of your home’s equity.

2. What is the average interest rate for a home equity loan?

The average interest rate for a home equity loan varies depending on current market conditions, your credit score, and other factors. It’s always a good idea to compare rates from multiple lenders to find the best deal.

3. How long does it take to get approved for a home equity loan?

The approval process for a home equity loan can take anywhere from a few days to a couple of weeks. This depends on the individual lender and how quickly you can provide all the necessary documents.

4. What are the potential risks of a home equity loan?

The primary risk of a home equity loan is foreclosure if you fail to make your loan payments. This could lead to losing your home and damaging your credit score. It’s essential to ensure you can comfortably afford the monthly payments before taking out a loan.

5. Is a home equity loan the right choice for me?

Whether a home equity loan is right for you depends on your individual financial circumstances and needs. If you have built up substantial equity in your home, need a lump sum of cash, and have good credit, a home equity loan may be an option. However, it’s essential to carefully consider the risks and potential consequences before making a decision.

So there you have it – five ways to use a home equity loan to your advantage! Remember, these are just a few examples, and there are many other creative uses for this financial tool. As you explore these options, always weigh the risks and rewards associated with borrowing against the potential benefits. Consider factors like your current financial situation, interest rates, and long-term goals. If you’re unsure about whether a home equity loan is right for you, consulting with a financial advisor can be incredibly helpful. They can help you understand your options, create a personalized plan, and make informed decisions.

Ultimately, your home equity loan should be a tool that helps you achieve your financial dreams. Whether you’re looking to renovate, invest in your education, consolidate debt, or tackle a major life event, this loan could be the answer you’ve been searching for. But remember, as with any financial decision, approach it with a clear head and a well-defined strategy. Do your research, compare options, and ensure you’re comfortable with the terms and conditions before signing on the dotted line.

We hope this guide has provided you with valuable insights into the world of home equity loans. If you have any questions, leave a comment below. And stay tuned for more informative and engaging content on all things personal finance! Happy borrowing, and may your home equity work wonders for you.